Business Insurance in and around Fayetteville

One of Fayetteville’s top choices for small business insurance.

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Running a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for the ones you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, a surety or fidelity bond and extra liability coverage.

One of Fayetteville’s top choices for small business insurance.

Helping insure small businesses since 1935

Insurance Designed For Small Business

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a lawn care service business, an ice cream store or a dry cleaner. Agent Ann McLeod is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

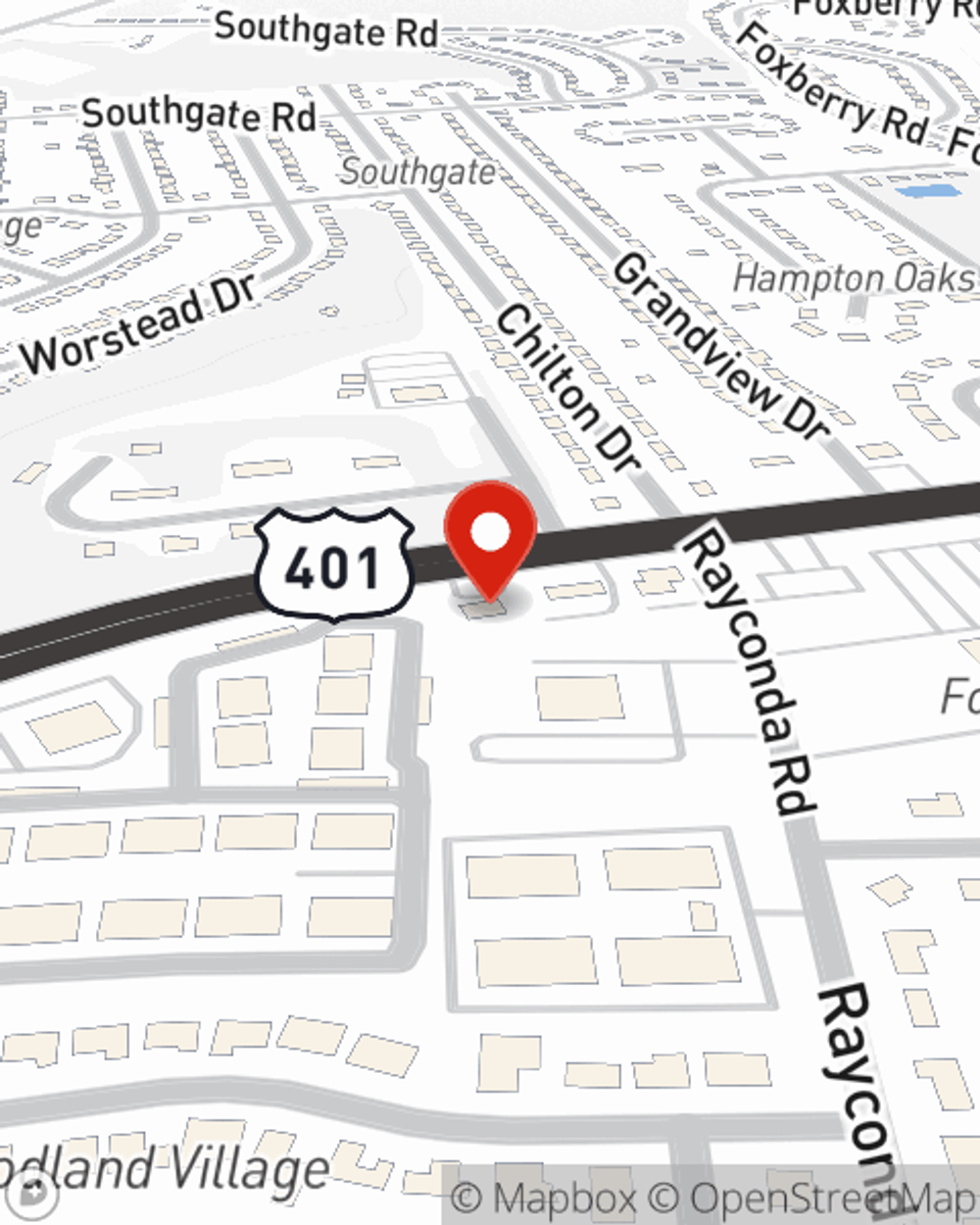

Get right down to business by visiting agent Ann McLeod's team to talk through your options.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Ann McLeod

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.